How can I apply for an IPO through WhatsApp?

IPO applications on WhatsApp can be made using mobile numbers registered/ unregistered with your Geojit account. Unregistered numbers will have to validate the application with an OTP sent to their registered mobile number/email ID.

To apply, add 9995500044 to your contacts:

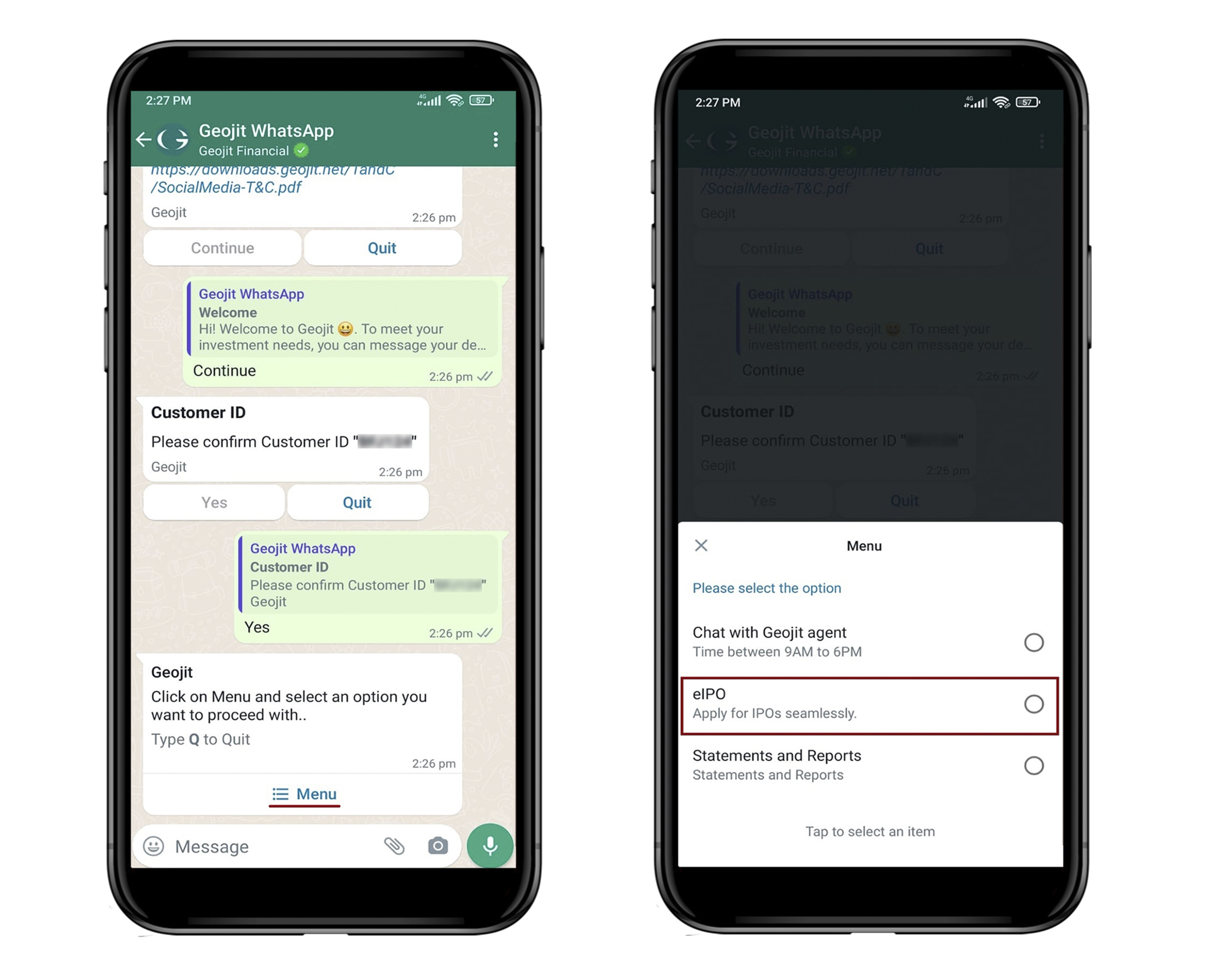

Step 1. Connect to the Geojit chatbot by sending Hi/Hello to 9995500044 > Continue

Step 2. i. Geojit Registered Numbers- Confirm your Trade Code by clicking Yes

ii. Geojit Unregistered Numbers- Enter your Trade Code and confirm by clicking Yes

Step 3. Select eIPO from the menu

Step 4. Enter the OTP sent to your registered mobile number/ email ID

Step 5. Choose Place Bid by entering the option number (1)

Step 6. Select the IPO by sending the desired option number

Step 7. Select your Category by entering the desired option number:

- Retail Individual Investors

- Individual Investors (HNI)

- Employee / Shareholder / Employee / Policy Holder

Step 8. Confirm the selected IPO by clicking Continue

Step 9. Select your Demat Account

Step 10. Enter your bid quantity (number of shares)

Step 11. Select your bid price- Cut-off / Choose Price (to enter the desired bid price)

Step 12. Enter your UPI ID

Step 13. Read and Accept the Terms & Conditions

Step 14. Confirm your Order Summary

Your bid request will be sent to the exchange, and you will be provided with an IPO application number.

Step 15. A fund block request will be sent to the UPI ID entered in the application. Bid confirmation is subject to the successful blocking of funds via UPI:

- Open the UPI app

- Check the application details

- Approve the fund block request

Learn how to check your IPO application status.

Step 16. Enter M to go back to the Main Menu / Q to Quit

* Resident Individual, HUF (applying through their Karta), NRE, NRO & NRO-CM clients can apply through the eIPO facility, provided their bank account has the UPI facility.

* Investor categories include:

> IND- Retails Individual Investors can place bids up to Rs. 2 lakhs.

> IND (HNI)- Individual Investors can place bids for Rs. 2 lakhs to Rs. 5 lakhs. Applying at the cut-off, bid modification to reduce the bid price, and bid cancellation are not allowed for this category.

> Bids above Rs. 5 lakhs must be placed using the net banking ASBA facility provided by the bank.

* For shareholders/employees/policyholders of the concerned company, there is a provision to apply under the respective category (if there is such a reservation in the IPO).

* The IPO order entry facility is available between 10:00 a.m. and 5:00 p.m. (IST) during the issue period (excluding Saturday, Sunday, and market holidays).

* On the issue close day, applications are acccepted till 3:00 p.m. and may be extended, subject to the exchange bidding time.

* Investors must use their own bank account and UPI ID to apply for IPO applications. Using third-party bank accounts is not allowed.

* View the list of eligible UPI app.

* Investors can apply for eIPO via UPI fund blocking only if their bank is UPI 2.0 enabled. View the list of eligible banks.

* The cut-off time for acceptance of the UPI mandate is 5:00 p.m. on IPO closure day. Only UPI bids with the latest status as "Block Request Accepted by Investor" shall be considered valid. Investors are advised to place bids well in advance and approve the UPI mandate within the cut-off time.

* Only one application per PAN will be allowed under the same category. Multiple orders under a single PAN in the same category are liable to be rejected.

* Bid confirmation is subject to validation of the investor's demat account by the exchange and successful blocking of funds via UPI.

* Investors have to ensure that all activities related to the UPI payment process are completed after the bid is submitted to the exchange.

Still need help? Create Ticket